There has certainly been a lot of discussion lately about methane hydrates. You may have missed it unless you, like most concerned about global peak oil and peak energy, specifically search and listen for it. Most of that discussion, quite understandably in our energy-addicted world, has centered on the potential of using these vast reserves of methane as a fuel source. Methane hydrates, after all, contain more carbon energy than all of the world's oil, natural gas and coal combined.

Those estimates, like hot air, are, in fact, expanding all the time. Some estimates suggest methane hydrates may contain 3-4 times the carbon energy of all global fossil fuels combined.

For those not familiar, methane hydrates are molecules of methane gas (the basic constituent of natural gas) locked in a cage of water ice.

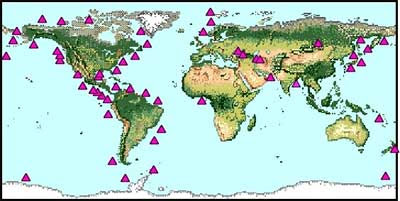

They exist in two places throughout the world. Marine methane hydrates exist on most of the world's continental margins, particularly along the subduction zone of tectonic plates such as along the west coast of North America. Methane hydrates also occur in land-based and sub-sea frozen permafrost in Alaska, Northern Canada, Russian Siberia, far northern Europe, and in small deposits in Antarctica.

The sheer volume of methane hydrates and their occurrence on shore in permafrost and near offshore on continental margins do make them an attractive prospect as a future, accessible, post-oil energy source. There has been far more research into the potential exploitation of methane hydrates than was ever the case for oil, natural gas or coal. The requisite geology and, now, the location of these deposits are well known. All that stands in the way of exploiting this vast energy resource - from the point of view of energy executives, economists and politicians - is the extraction technology, the global distribution technology and network, the economic evaluation and the financing to build the massive infrastructure that would be needed to effectively and efficiently exploit it fully. No problem! It may, in fact, still be several decades - in a business as usual climate - before all of these factors can be dealt with and methane from hydrates can be exploited commercially.

There are, of course, other points of view. Paleoclimatologists are increasingly convinced that massive and surprisingly sudden releases of submarine methane hydrates have been responsible for periodic and disastrous rapid rises of global temperature, largely resulting in the quick - in geologic terms - end of past ice ages. The study of deep ice cores from Greenland and Antarctica, the study of areas of ocean floor zones of extensive pock marks and growing evidence of current increasing methane releases from melting permafrost and the Arctic Ocean floor all strongly lend credence to this hypothesis.

All of that, of course, makes methane hydrates and their possible release as a gas into the atmosphere a serious concern, in this period of increasing concern about global warming, from an environmental point of view. Methane in the short term, you see, is 62 times more potent as a greenhouse gas than carbon dioxide. Over ten to twenty years time as it oxidizes in the atmosphere it weakens to just 20 times the potency as a GHG compared to carbon dioxide. After about ten years atmospheric methane completely oxidizes. But that isn't the end. It oxidizes into carbon dioxide and remains a greenhouse for another century.

Another, and perhaps the least understood and certainly the least discussed, point of view about methane hydrates involves physics. The physical nature of methane hydrates and the quite distinct physical properties of water - specifically H2O - and of methane (CH4) independently function both as a barrier to exploitation and as a serious environmental risk in conjunction with global warming.

Submarine methane hydrates primarily occur in what has been called the Hydrate Stability Zone. This is a relatively narrow zone where the combination of water temperature and water pressure are suitable for the formation and, more important, the stability of methane hydrates. In general, at present, this is 300 to 500 meters below the ocean surface but varies and is very specific in different locations depending on water temperature. The geology of the area is also a very important factor; whether the bottom is sandstone, other stone, coarse silt or fine silt. All of these variables affect the ability to form methane hydrates and the way those hydrates will be distributed in that medium.

All methane hydrates, you may have guessed from the above, are not created equal. The water ice that forms the hydrate cage and the methane gas in that cage are both essentially consistent but the manner in which they combine to form the hydrate varies considerably. And so does the volatility and stability of those deposits.

I will not go into a great detailed discussion of those differences. I will limit it to a couple of key factors.

Water - more specifically H2O which is only water above 0C and becomes vapour at higher temperatures - reaches its maximum density of 999.9720 kilograms per cubic meter at a temperature of 3.98C. At the freezing temperature of 0C its density has reduced to 998.8395 kilograms per cubic meter, 988.1170 at -10C. The critical part of that range, with regard to methane hydrates, is that from 0C to 3.98C. That is where we will focus.

The lower density of H2O as ice (998.8395) at 0C (even lower if the ice is super cooled) is what allows ice to float on the surface of water. Average global ocean temperatures today (this has varied over geological time, especially during different eras of ice age and global warming) is 2C. At 2C H2O has a density 999.9400 between that of ice at 0C of 998.8395 and the maximum density at 3.98C of 999.9720. It still supports, therefore, the lighter ice even in the Arctic.

Anyone in a northern climate is familiar with spring thaw. As the water below ice warms in the spring it first expands, pushing up and cracking the ice, until it reaches its maximum density at 3.98C of 999.9720. Above that temperature the water begins to shrink (will reach a density of 999.7026 at 10C) as the temperature rises, leaving a gap of air between the ice and the water below. The ice can, as most young boys in northern rural areas can attest, be left high and dry and collapse under the weight of a person walking on it.

Because of the lower density (greater buoyancy) of ice relative to sea water, submarine methane hydrates are always under pressure, physically wanting to rise to the surface. The deposits only become "relatively" stable when anchored by sufficient sediment on the ocean bottom. When and if that "anchorage" breaks down or is swept away, for example, by a sub-surface landslide, the hydrates can suddenly be released into the water and rise toward the surface.

Now the other side of the problem. At 1 atmosphere, methane is a liquid below a temperature of -182.5C. There is no known naturally occurring liquid methane on earth. Above that temperature methane is a gas. Its density constantly diminishes as the temperature/pressure gradient rises. To my knowledge, which is incomplete, scientists have not really answered the question of why the methane trapped in hydrates is stable in that form. The density of the gaseous methane in hydrates is 162 times greater than methane gas in the atmosphere. At the temperature and pressure of the sea water around and above the hydrate deposits, the methane gas contained in the hydrates should have much lower density (occupy much more space) than it does. This physical anomaly means that the pressure on the methane gas to expand is constantly at odds with and pushing against the ice cage enclosing it. This is a key component of the essential instability of methane hydrates.

Gas density generally decreases far more rapidly for gases than liquids or solids as temperature rises or pressure decreases. That means two factors can affect the stability of methane hydrates currently in the hydrate stability zone. Changes in sea level can affect the water pressure in the zone: a drop in sea level can decrease the pressure. Changes in temperature of the water can have the same effect. Increase of the temperature above the current average 2C can also dramatically affect that stability.

Global warming, ironically, fortunately means we are in an era of rising sea levels, not lowering sea levels. The pressure that pushes down on and stabilizes methane hydrate deposits in the oceans is, therefore, increasing, not decreasing. Global warming, however, also means that water temperatures, as well as atmosphere temperatures, are on the rise.

Much of the debate around global warming centers on whether we are heading for a global temperature increase of 2C, 4C or higher. On the surface these seem like such small numbers to be the center of such passionate debate. But the critical temperature spread we are dealing with is between 2C (the current average global ocean temperature) and 3.98C (the temperature at which H2O reaches its maximum density (it will shrink, lowering sea level and decreasing oceanic water pressure between those two temperatures) and begins to decrease in density: begins to expand again). That is a temperature differential of just 1.98C.

As the ocean temperature rises it doesn't matter what the specific temperature in the local hydrate stability zone currently is because that zone is a product of both temperature and pressure. In the Barkley Canyon off the coast of Vancouver Island, for example, the hydrate stability zone is at a depth of 850 meters, much deeper than the normal hydrate stability zone of 300m to 500m depth in other locations. As the temperature in the hydrate stability zone rises at whatever depth it occurs, however, the stability of the hydrates will diminish.

The individual physical characters of the water ice that makes up the hydrate cage and the methane gas trapped inside accelerate this instability. As the temperature rises (generally from 2C to 3.98C) the ice forming the hydrate cage shrinks as it is influence by the temperature of the surrounding water and begins to soften as the physical bonds holding the ice in a stable structure weaken. This shrinking puts further pressure on the methane gas inside, increasing its density. But the methane gas inside that cage is already 162 times the density it is at 1 atmosphere and is under considerable pressure to expand. As the temperature rises in the hydrate stability zone and the ice cage weakens and the methane gas's pressure to expand increases, the stability of the hydrate diminishes rapidly. The upward pressure on the hydrate ice, which wants to float up to the surface (the methane gas trapped inside is also more buoyant than the ice or the surrounding water), also increases as the temperature rises.

To my knowledge no scientific studies have yet been conducted that pinpoint exactly where on the temperature/pressure gradient the water ice cage of the hydrate ruptures and releases the methane gas into the surrounding environment. There is mounting evidence that the number of subsea methane vents in the Arctic, which is generally warming faster than other oceans, is increasing, as is the volume of methane gas issuing from those vents. This suggests that, in the Arctic at least (which holds the highest concentrations of methane hydrates of all the oceans), the temperature rise is already compromising methane hydrate stability.

In areas of fine sea bottom sediment, which is the case in the majority of methane hydrate deposits, the methane hydrates form stratified seams. Proceeding downward, each seam acts as a "cementing" cap, holding hydrate seams and free methane below in place. The disassociation or breakdown of hydrates as the ocean temperature increases will proceed from the top of the hydrate deposit downward. In these seamed, soft-sediment deposits that means that the top seam, which functions as a cap on all the methane and hydrates below, will break down first. It's ability to function as a cap disappears and the risk of a rapid, potentially massive release of methane increases dramatically.

The same sort of results that can occur naturally through warming of the waters around the methane hydrate deposit can also occur if the submarine methane hydrate deposits are destabilized by human activity. Any attempts to drill into methane hydrate deposits, whether exploratory or commercially for energy production, can break down the stability of the hydrates, particularly in association with rising temperatures, either in the surrounding sea water or from the drilling itself (the favourite intended method of extraction is to inject hot water into the hydrate deposits).

The current discussion and debate surrounding the intended exploitation of methane hydrate deposits involves energy experts, various types of scientific experts, and anxious, eager governments. If that is where it stays I am not very confident that scientific reason and caution will win out. The general public, including you, must put methane hydrates on their radar and be prepared to hold accountable those pushing for methane hydrate exploitation. Public pressure must become a key element of making sure that we do not rush into over-exuberant and overly-optimistic exploitation of this resource, to the detriment of mankind, other living species and the planet itself.

AUTHOR'S NOTE:

Hundreds of articles, papers and web sites were researched as part of writing this article. I have not listed them here as the list would be far too long. If anyone is interested in those references and links, however, they can contact me by e-mail and I will gladly supply them. My e-mail address is; richard.embleton@sympatico.ca

Hundreds of articles, papers and web sites were researched as part of writing this article. I have not listed them here as the list would be far too long. If anyone is interested in those references and links, however, they can contact me by e-mail and I will gladly supply them. My e-mail address is; richard.embleton@sympatico.ca

Also see my other Methane Hydrate articles in this blog;

Methane Hydrates: What are they thinking?

http://oilbeseeingyou.blogspot.com/2008/12/methane-hydrates-what-are-they-thinking.html

Methane hydrates: the next great energy source?

http://oilbeseeingyou.blogspot.com/2006/12/methane-hydrates-next-great-energy.html

http://oilbeseeingyou.blogspot.com/2006/12/methane-hydrates-next-great-energy.html